Scale Marketing & Consulting

Kamish Bhai, Qile Cao, Johannes Henkel, Karan Kishorepuria, Michael Mizus, Zhiping Wang BSBA

Subject area: Corporate Strategy of Extension & Positioning

Region: Greater Boston Area

Industry: Real Estate Industry

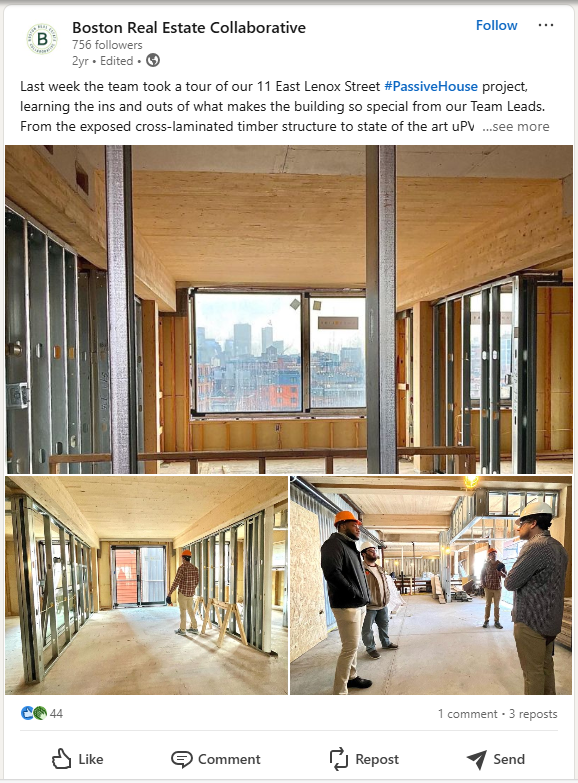

Company: Boston Real Estate Corporation

Challenge: Boston Real Estate Corp. (BREC) is a small development and brokerage firm operating in the Greater Boston Area (GBA). In early 2021 the real estate (RE) market was at an all-time high, and BREC’s CEO, Mr. Liu, needed to raise funds from current and new investors while differentiating BREC in the process. BREC faced the corporate challenge of extension and positioning, as they required a competitive advantage to pitch to investors and service homebuyers. Ultimately, BREC needed to develop a sustainable business. To achieve this goal, BREC needed additional sources of revenue. They had two customer segments to address: affluent homebuyers and Chinese investors.

Investment in Personal Capital: Elucidating Professional CORE

Each of our team members has an interest in either the real estate market or the financial investment industry. Working to improve BREC’s standing in this market will help us strengthen our knowledge and capabilities. BREC is a small company; this allowed us to work closely with the CEO and understand BREC as a whole. This case provides us an experience that we can apply to our future aspirations. Our group is in a good position to help BREC achieve its goals:

- Zhiping Wang – BS in Economics and Finance, utilized knowledge in urban economics and real estate experience from interning at BREC to work on strategy implementation and communicate with the client.

- Johannes Henkel – BS in Entrepreneurship & New Venture Management and minor in Design, utilized financial knowledge and experience in venture capital to work on strategy development.

- Michael Mizus – BS in Finance and minor in Business Analytics, utilized analytical skills and consulting experience for early-stage ventures to find new opportunities in the industry that meet BREC’s strengths.

- Kamish Bhai – BS in Management Information Systems, utilized experience in graphic design and operations to suggest improvements in BREC’s value chain and control systems.

- Qile Cao – BS in Finance and Accounting, utilized financial knowledge and IBD internship experience to work on market analysis and accounting expertise for financial analysis.

- Karan Kishorepuria – BS in Finance and minor in Nutrition, utilized extensive knowledge of working with startups to understand BREC’s challenges and provide key strategic insights.

Investments in Social Capital: Building Trust within the Company and Industry

- To understand BREC’s challenge and situation, we interviewed the CEO who provided us with information on BREC’s business model, history, competitors, capabilities, vision, and goal.

- After gaining this insight, we collected publicly available data from over forty sources on the company’s external opportunities and threats. We researched market size and growth potential, competitive forces, and BREC’s political, economic, social, legal, and technological environments.

- We conducted a stakeholder analysis to understand the desired outcome, expectations, and boundaries. We also built an industry canvas comparing BREC’s offerings to their direct competitors.

- We evaluated BREC’s resources and value chain using the VRIO framework to understand the firm’s internal strengths.

- Our findings allowed us to create a SWOT diagram, which provides a comprehensive summary of our research as an exhibit within our report.

Investments in Professional Capital: Analysing Market Needs, Crating an Industry Map

Following the research stage, we moved to analyze and match BREC’s internal strengths with their external opportunities in order to develop the following value propositions:

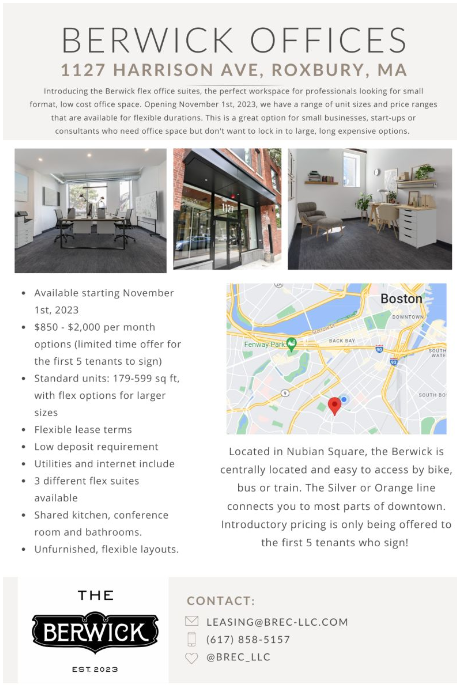

- Turn investors into customers to add another source of revenue.

- Differentiate by maintaining and renting properties for foreign and domestic clients.

These recommendations are based on BREC’s strengths, such as their close connection with Chinese investors, ownership of securities and brokerage firms, existing relationships with contractors, and extensive knowledge of the RE market. These match the opportunities of a booming US RE market, Chinese demand for US RE investments/developments, lack of maintenance services offered by competitors, and foreign investors/customers’ lack of knowledge on Boston RE.

To realize these recommendations, we suggest BREC formulate a competitive strategy of focused differentiation for Chinese investors and affluent homebuyers, with a focus on drivers such as superior customer service, unique insights into customer needs, high-quality projects, and value-added services. We also suggest the firm move towards a dominant business level of diversification by adding more revenue sources to become sustainable. In order to implement this, BREC should adopt a simple organizational structure by hiring a few employees, and they should develop a culture that values ethics, quality, and building/strengthening existing relationships and diversity. To avoid potential moral hazards and principal-agent problems, BREC should implement quality controls, reward systems, a code of ethics, and emphasize intrinsic motivation. These strategies and organization design changes will allow BREC to carry out their vision of refreshing Boston RE and accomplish their goal of expansion and developing a sustainable business.

Capital Utilization: What’s next?

- Quote from Mr. Liu: “You have identified some great strategies and market opportunities for my company. The recommendations are very solid. Some of them confirmed what I have been thinking for a long time. You also uncovered hidden company resources I had not thought of, which will help me think outside the box! I will certainly implement those into my company’s operation plan!”

- We helped BREC realize they have unique core competencies they can utilize and further strengthen in order to expand the business going forward. Our report helps Mr. Liu scale-up RE development, increase net profit, and maintain investor confidence. BREC can use the Action Plan we created to implement our recommendations.

- The knowledge learnt from this case will help the team with portfolio analysis, especially in RE properties and also for start-up companies. Several team members’ families are involved in RE. This experience will allow them to develop skills required to operate in the RE industry and determine if they want to work alongside their family.

- BREC’s challenge of how to fund their expansion allowed the team to understand the kind of investments businesses require to grow and how to finance those decisions.

0 comments

Write a comment